.png)

Our Home Perks

POWERED BY STREAMLINE TEAM AFFINITY PARTNERSHIPS

.png)

Contact Us:

(702) 389-1401

In the market to buy or sell?

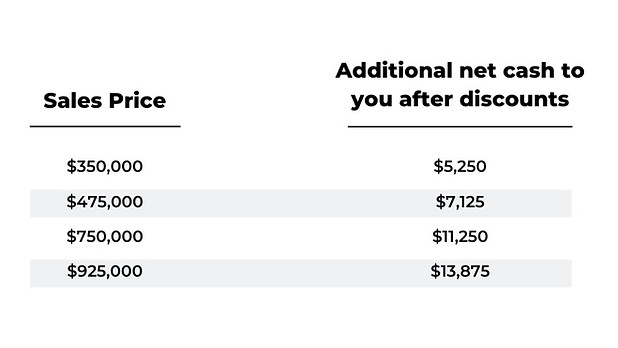

As a University Medical Center employee, our Home Perks program puts money back in your pocket! Receive a minimum of 1.5% of the loan amount back when buying a home, up to $30,000. Additionally, pay ZERO origination fees, ZERO processing fees, and ZERO underwriting fees, for an additional average savings of $1,700!

Program Details

-

For University Medical Center employees

-

There is no re-capture period, meaning you never pay the money back

-

Apply your money towards closing costs, rate buydowns, or pre-paids

-

No interest rate adjustment, meaning you will not be given a higher rate to receive the credit

-

No area or income restrictions

-

Immediate and extend family members are eligible to receive 50% of the benefit

-

University Medical Center employment is the ONLY requirement to qualify for the program

-

Secondary and investment properties eligible

Common Questions

With our premiere mortgage banking, you're in good hands!

We are proud to be the top retail mortgage brokerage in the country, where we can provide our own financing for your home loan, or shop through hundreds of lenders throughout the U.S. to find the right loan for you. We use experienced teams and sophisticated software to get your loan closed and welcome you home!

.png)

Phone: (702) 389-1401

Email: info@ourhomeperks.com

© 2025 by Our Home Perks- UMC. Our Home Perks- UMC is an affinity program offered by SHL Affinity Partnerships to the University Medical Center Southern Nevada. This program is operated by Streamline Team at CrossCountry Mortgage, Branch 3493. Equal housing opportunity. All loans subject to underwriting approval. Certain restrictions apply. Call for details. All borrowers must meet minimum credit, income, loan-to-value, debt-to-income, and other requirements to qualify for any mortgage program. CrossCountry Mortgage, LLC NMLS858979 (www.nmlsconsumeraccess.org).